Back in the 1990’s I observed some hard lessons about executive intransigence through paradigm shifts. The UK music industry was one of the country’s biggest export sectors with revenues that exceeded its water industry. Five big companies controlled the majority of revenues. They had succeeded in persuading consumers to shift their buying habits through a series of physical formats from vinyl, 8-track, cassettes, compact disc, video disc and even something called Blu-ray. Some new techs were more successful than others, but each had an incremental benefit to consumers, generated growth for the industry, and with control over up-stream and down-stream supply chains, the industry was able to force consumers to buy replacements. Senior executives had a generic belief system and the modus operando of the industry was well established. Many in the industry leadership were baron type figures with cashmere coats, cigars, swiveling in their leather office chairs. They had fought off copyright breaches like “Home taping is killing music” and managed to retain control and the lion's share of margin. They had even improved their risk exposure by controlling artist development. They felt protected and accustomed to annual 4-6% industry growth rates. Many believed that digital music was just the next format, although some began to panic when they realized that their artist contracts didn’t cover digital rights. In year one of the i-pod the industry revenues tanked, dropping by 40%. The cigar box was suddenly empty.

In the early 21th century Danny Rimer, a formidable venture capital investor in disruptive tech, was regularly questioned on the secret formula for picking a series of winners. One of his early picks, Skype, threatened the long-standing telecoms industry by porting calls onto data networks, ripping up the price architecture of the industry. When questioned on the key factors of industry disruption, Rimer noted that industries with long-standing belief systems, where many of those beliefs were commonly held, were the most vulnerable to new disruptive players who changed the rules. Key to disruption is the existence of a group of longstanding industry beneficiaries who feel seismic change is unlikely and perhaps the new tech will just be incremental.

This week COP28 kicks off in UAE, a conference of parties, the annual meetings of the United Nations Framework Convention on Climate Change. The first global stock take of climate action to be concluded at COP28 suggests the world is off-track to meet the goals of the Paris Climate agreement to limit global warming to 1.5 degrees above pre-industrial levels.

Conference President is Dr Sultan Al Jaber, a formidable business leader who amongst other things is CEO of ANOC, the UAE state oil company. He has been very pro-active and supportive of preceding COP agendas, but like all leaders he must carry the expectations of his stakeholders. In his case that is an incredibly broad and conflicting group of interests. This has led climate campaigners to suggest that “a fox is running the hen house”, not helped by allegedly leaked papers suggesting he would also be facilitating meetings to develop new oil and gas deals at COP28.

The management problem for Dr Al Jaber is that he sits on both sides of disruption and legacy. It’s perhaps unprecedented to attempt to be a pro-active disrupter and institutionalized incumbent at the same time. On the other hand, it could be a potent mix for energy transformations leading the industry to a new future. A soft option might be to solely address geo-political concerns of the global south and throw some cash at the problem, without addressing the elephant in the room, the emissions from fossil fuels.

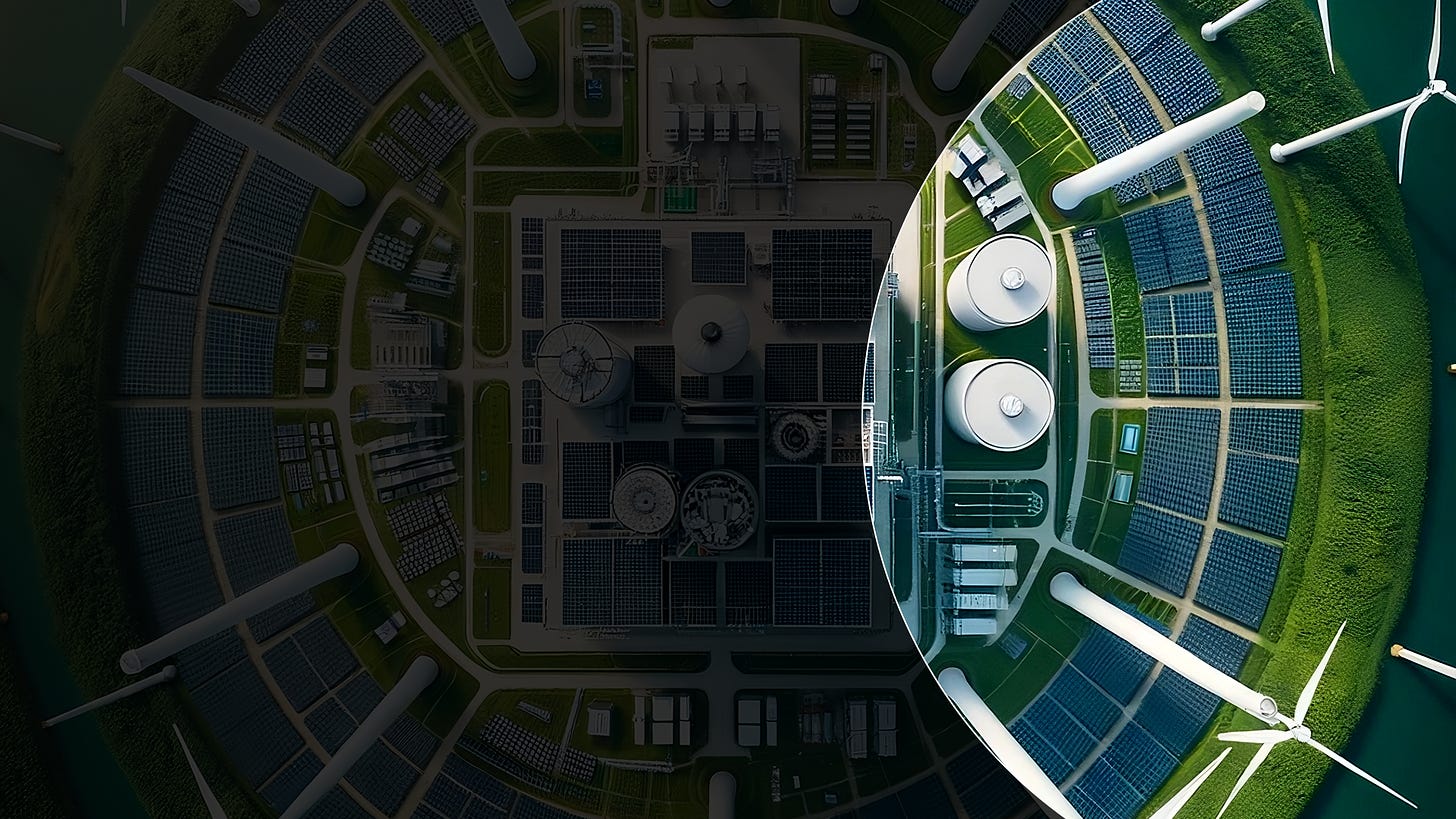

If you apply the rules and history of industry disruption, it is clear that the giant energy sector has all the right ingredients for a big shake up between now and 2050. Some incumbents may try to put a brake on a low energy transition, but global momentum and technology development is for change. New Clean Tech is surfing a transformational wave with the backing of companies, insurers, shareholders, and governments. The opportunity is without recent precedent and part of a $100 trillion deployment of capital between now and 2050.

A big hope of holding COP28 at the heart of the oil and gas industry is that more skeptical executives will, for the first time, see a world of opportunity on their doorstep. In 2022 sales of electric vehicles accounted for just 0.2% of new car sales in UAE, whereas in the UK they stood at 17%.

GCC countries now have some of the most ambitious global plans for the deployment of clean technology. They possess unique combinations of resources and expertise to catalyze green energy transitions. Let’s hope Dr Al Jaber can make a bit of history and enable a low carbon energy transformation.